The Cost of Optimism.

Real examples where the Challenger Model identified valuation air-gaps before the funds were wired.

Request Full Diligence Memo

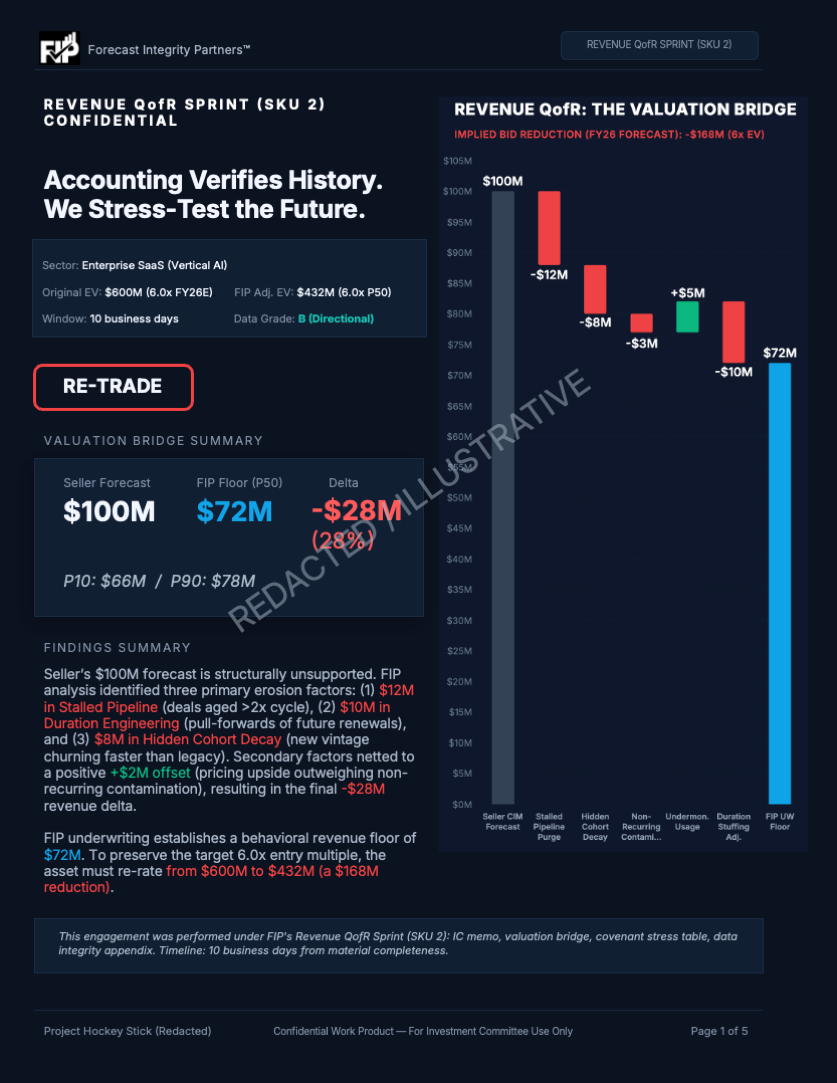

Review the complete 5-page "Project Hockey Stick" artifact, including Covenant Stress Test and Deal Protections.